Overview

Ensure accurate, efficient and compliant tax reporting.

Use this feature to extract and export section 18A donor information as required by SARS.

Topics

•Set up your export files for one or more entities. •Export the files per entity using the HTTPS channel. |

•SARS IT3(d) data needs to be submitted every six months. •If no donations have been received, a NIL reporting declaration is required. •View the tutorial below to see how. |

•Do not change the SARS export file name or its contents in any way as it is formatted as required by SARS. •The name and content of the SARS result file must also remain unchanged for successful import into DevMan. |

|

|||||||||||||||||||||||||||||||

•For the first export, go to Finance > SARS IT3 > Exports > Transactions due. •For further details, please view the tutorial below.

•Import the SARS response file and work through fixing donor/donation details. •To re-export, go to Finance > SARS IT3 > Exports > View and navigate to the SARS export record. •Click through and then select Action > Export to generate a new export file. •For further details, please view the tutorial below. •Import SARS result file.

Repeat these steps until the SARS result file report shows: •Donor | Validation failed = 0 •Transaction | Validation failed = 0 |

Generate a SARS IT3(d) export file |

SARS will generate an R005 or R006 result file showing which submissions have failed. You can import the file to DevMan on the Finance page by selecting SARS IT3 > Imports > Import file. Once successfully imported, you can view the statistics under SARS IT3 > Imports > View import batches.

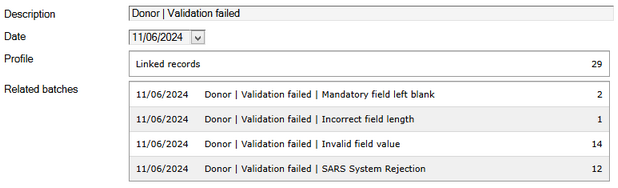

Here is an example of what the import might look like:

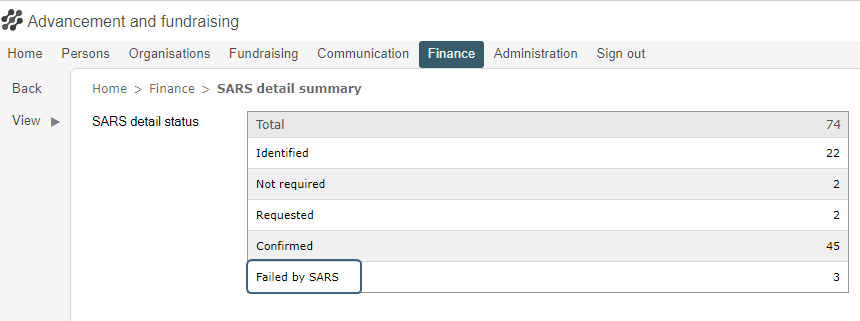

By clicking through on each section, and you will be able to open the individual records that have incorrect or missing data. You can now decide how to proceed by fixing the errors directly or engaging with your donors to get additional information. Where donor details have been flagged as failed by SARS, the status on the SARS detail page will be updated.

Once you have worked through a round of fixes, you can do a new export of all entries marked as previously failed. SARS allows for multiple uploads. |

How to re-export a SARS IT3(d) file |

Please note: Only do a nil export for a period where an export has not previously been generated.

SARS IT3(d) NIL reporting declaration |

|