Empower donors to effortlessly update their own tax details.

Simplify your tax-related tasks.

•Donors can update their tax details using the new self-service portal.

•Add the portal link to your website, social media page or send via email.

•Records reflect immediately in DevMan, ensuring up-to-date information. |

•Add the following link to your website, social media etc.

ohttps://yourcompany.devman.co.za/tax/portal/ |

•On the Finance page, go to 18A receipts > SARS detail and select View to see donors identified as needing to update their details.

•Send a bulk email to these donors using a template which includes wording with this link: module://tax/portal/?t=@Token

oThe Data source must be bulk communication and the type SARS detail.

oWhen adding the link to the template, link the wording by clicking on the chain link and make sure that the protocol is set to <other>.

•For new donors, you can set up a workflow so that the link will be sent to them automatically or add it to your thank you email template.

SARS self-service update link |

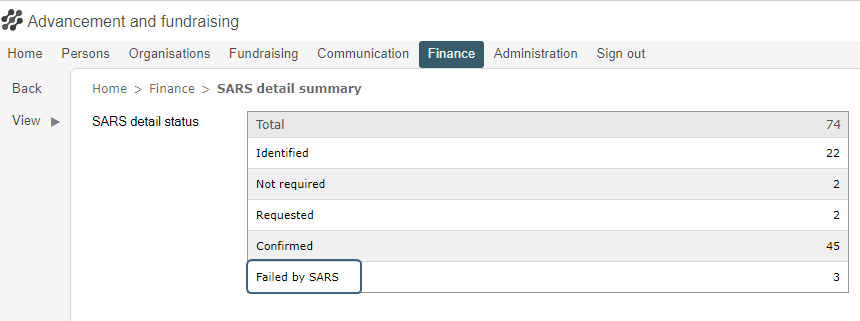

•On the Finance page, go to 18A receipts > SARS detail and select View to see the SARS detail status of donors.

•Click through on Failed by SARS to view the list of donor profiles with incorrect details.

•Each time a results file is processed, the status entry will be updated.

SARS detail status |

•If you receive a donor's tax details via email or phone, you can add them manually in the donor profile.

•Select Edit, and then click on Update next to SARS details.

Manually add SARS details |